Quoted: Nathanael Fast in BBC

Fast explains that Australia's social media ban for children under 16 could be a proof of concept for other countries to do the same.

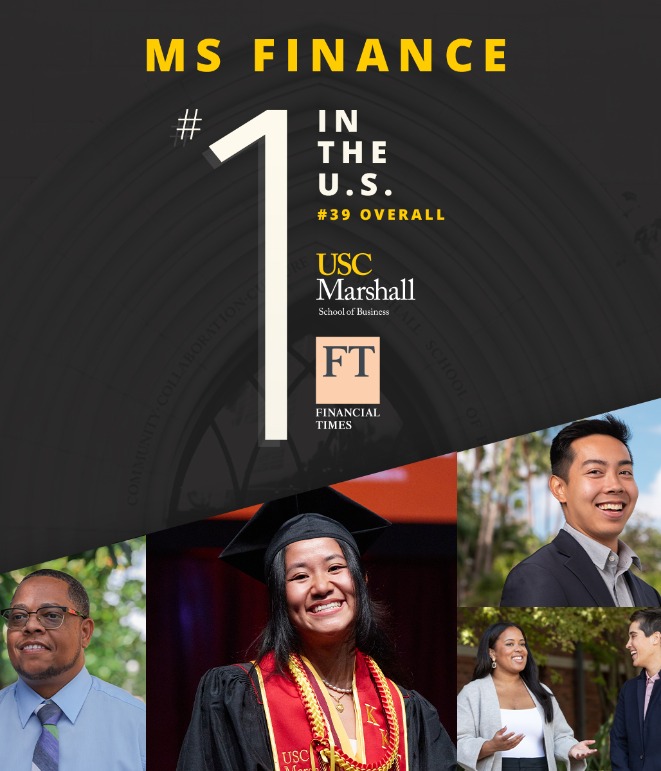

Financial Times Names Marshall’s Master of Science in Finance Program #1 for Second Straight Year

Financial Times Names Marshall’s Master of Science in Finance Program #1 for Second Straight Year

Flexibility, real-world learning, and diverse programming meet student needs and employers’ demand in the premier program.

Financial Times ranks Marshall’s Master of Science in Finance #1 for second consecutive year

[USC Photo]

For the second consecutive year, Marshall’s Master of Science in Finance (MSF) program is ranked #1 in the United States by the Financial Times. The ranking is determined by two sets of criteria: school data including the program’s international reach and the diversity of faculty, board members, and students by gender and citizenship; and an alumni survey that calculates current salary averages and the difference in salary before and after completing the master’s program.

The MS in Finance is a pre-experience program designed for young professionals early in their careers. Grounded in a rigorous STEM curriculum, students have the opportunity to explore their course options through flexibility and specialization across a variety of functions, including commercial and investment banking, quantitative research and trading, risk management, venture capital, private equity, sales and trading, impact investing, and fintech.

According to experts, Gen Z professionals seek a return on investment when it comes to their future prospects and are leaning toward careers in finance and accounting. After just 16 months, Marshall’s MS in Finance program graduates students ready to join the finance sector immediately.

“If you compare Marshall’s program to other schools across the U.S., and even in Asia or Europe, they are not doing the experiential learning to the same level that we are,” said JULIA PLOTTS, outgoing MSF academic director and professor of clinical finance and business economics. “A foundation of real-world projects that complements theoretical knowledge is far more valuable to employers. Companies like our students because they’re strong and that is what makes them attractive for placement.”

Regardless of the student’s aspirations, the MSF program has a path for them.

“If a student comes in and is interested in consulting, then we want them to have access to all of our amazing management and organization faculty who teach these strategy courses,” Plotts continued. “Some of them will go into asset management, others will choose corporate or real estate finance. The program was built to offer unique elective courses that leverage the expertise of our faculty across departments and centers.”

The diversity of electives offered — finance, strategy, entrepreneurship, and data science — enhances the classroom experience and provides mentorship and networking opportunities as MSF students overlap with Marshall MBA and other specialized master cohorts within these courses.

“The MSF curriculum gives students a strong technical background in all aspects of finance — securities valuation, investments, risk management, and more — that are increasingly required in the finance industry to remain competitive as new technologies increase the speed and sophistication of our financial markets and businesses,” explained Shane Shepherd, academic director for the Master of Science in Finance Program and an assistant professor of clinical, finance, and business economics. “Marshall’s MSF program aims to place our students at the forefront of this curve.”

A foundation of real-world projects that complements theoretical knowledge is far more valuable to employers. Companies like our students because they’re strong and that is what makes them attractive for placement.

— Julia Plotts

Outgoing MSF Academic Director and professor of clinical finance and business economics.

Throughout all of Marshall’s programs, the school places a huge emphasis on the importance of real-world learning so students can apply what they learn in the classroom and excel in the workplace.

Student organizations and extracurriculars can play a key role in this specialized education, according to Plotts, as they offer “great opportunities for experiential learning if students take advantage of those opportunities.”

MSF students can participate in incremental student startups and incubators, international project-based experiences, and student-managed investment funds, which allow participants to manage hundreds of thousands of dollars each year. The opportunities MSF provides are unique to the program, offering a comprehensive experience for students.

Beyond curriculum and activities, the MSF program also benefits from Los Angeles’ close proximity to media and entertainment, tech, health, and other growth industry hubs, as well as the expansive Trojan Network of alumni mentors and connectors willing to support career advancement.

Today’s cohort of 140 or more students have a variety of interests and goals. The MSF program allows them to focus and customize their education, creating a program tailored to meet their career goals.

The deadline to apply for Round 1 (2025–2026 academic year) is November 1, 2024.

RELATED

Quoted: Nathanael Fast in BBC

Fast explains that Australia's social media ban for children under 16 could be a proof of concept for other countries to do the same.

Cited: Shon Hiatt in E&E News

Shon Hiatt quoted, "It is not surprising that gas is getting a boost as AI deals get larger and technology companies look for around-the-clock power."

Quoted: Kerry Fields in LA Times

Fields explains how Paramount’s negotiations with Middle Eastern wealth funds sewed doubts over their financial commitment to a deal with Warner Bros.

Cited: Richard Sloan in Bloomberg Tax

Sloan’s research shows that financial auditing and accounting cases usually decline during the first year of a new presidential administration as new division directors are hired.

Marshall Faculty Publications, Awards, and Honors: November 2025

We are proud to highlight the many accomplishments of Marshall’s exceptional faculty recognized for recently accepted and published research and achievements in their field.